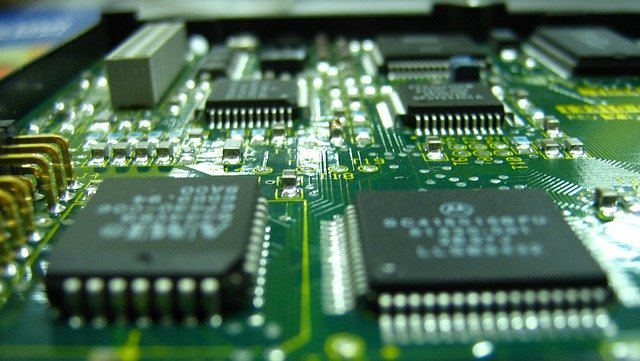

The shortage of semiconductors threatens catastrophe in the global economy

The shortage of semiconductors threatens catastrophe in the global economy

Driven by oversupply in the pandemic, the semiconductor crisis will last at least another two years and could represent a $0.5 loss for the global economy.

The demand for semiconductors is no longer for one or two applications, but rather an expanded structural shift in the economy towards digitalization and automotive.

The Deloitte Global TMT Predencies 2022 report identifies global TMT (technology, media, and telecommunications) trends and examines a number of them currently being driven by the economic and social changes caused by the global pandemic.

Check also:

In their 2022 report, Deloitte experts mention: the prolonged shortage of semiconductor production, the development of artificial intelligence and related regulatory measures, as well as the growing interest by many governments and venture capital funds in the development of quantum computing technologies.

The outbreak of the epidemic in many branches of the global economy has acted as a catalyst, dynamically generating or accelerating the development of some technological areas. On the other hand, changing conditions have become the driving force behind innovative tools and services. On the other hand, however, production capacity constraints or disruptions in supply chains have left an important mark both on the financial results of many companies and on their ability to further expand technical, market, cloud engineering and TMT, Deloitte.

In 2022, the problem of shortages in the semiconductors that are currently used almost everywhere will continue to exist. However, the crisis related to the insufficient supply of it is more evident in the automobile industry mainly. An attempt to configure more advanced car equipment ends with information about the lack of options or an exceptionally long waiting time for delivery. Deloitte expects the semiconductor shortage crisis to last at least 24 months, with an estimated total economic impact of more than $0.5 trillion.

As commenting on the findings of the report, Sibor Obi, Director, Technology/IT Team Leader for M&A, Deloitte, “The pandemic and the resulting logistical problems are the cause of the current situation only to a limited extent. The biggest reason is the gradual digitization, to which we are accustomed to the spread of chips. Simple and cheap, as well as developing advanced solutions using computing power – artificial intelligence, cloud data processing, cryptocurrency, Internet of Things, 5G. The more sophisticated the technology, the slower it is produced and the more time it takes to transfer knowledge, training and implementation.”

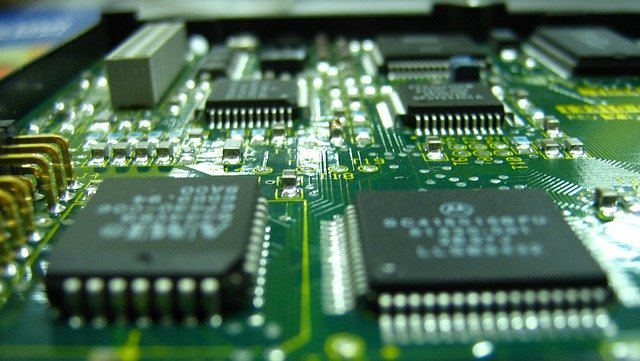

In the middle of 2021, the lead time for orders in the semiconductor market was 20-52 weeks, but experts predict that it can be shortened to 10-20 weeks by the end of 2022, and the industry may return to balance by 2023. Investments in this field will certainly contribute In the stabilization of the situation, such as Intel’s investments (for example, a plant worth 20 billion US dollars in Oregon, USA). Although the construction of a new chip factory will require several years of work and an investment of 10 billion US dollars, the largest integrated circuit companies have planned to spend 200 billion US dollars in 2021-2023. To increase production capacity. As a result of completing previous investments that started in 2019 and 2020, production is expected to increase by 35% by the end of 2022.

The solution to the shortage problems of integrated circuits on a global scale may also be influenced to some extent by the production of chips in the open source model, particularly based on the open standard RISC-V. This approach accelerates the possibility of starting production of new processors by countries that have not yet associated with this type of technology.

Moreover, venture capital investments in companies that produce integrated circuits have reached record levels. Deloitte predicts that in 2022, VC funds around the world will invest more than $6 billion in it. – This amount is slightly less than it was in 2021, but still significantly exceeds the expenditures recorded in the past two decades.

Mergers of companies operating in the semiconductor space lead to the creation of new companies that are more attractive to venture capital investors. Given that the average transaction value in 2021 was estimated at $25 million, nearly three times the average of most Other transactions in this century, IC startups are well funded and well funded. Funds for both innovation and security in case of failure says Agnieszka Zielińska, partner in financial advisory division, Deloitte.

Source: Deloitte