How to submit tax information in Google AdSense?

How to submit tax information in Google AdSense?

It is now mandatory to fill out tax information in Google AdSense, if you don’t then by default you will have to pay 24% US tax , and in addition to filling out the wrong tax form, you may have to pay more tax. In such case, this headache remains for new YouTubers, bloggers and other Adsense publishers. That is why we are going to tell you today through this article, how to fill in Google AdSense tax information? How is tax information presented in Google AdSense?

As we already said, if you don’t fill in the US tax information in your Adsense account, you will have to pay 24% tax by default, but if you submit the tax details, you will only get 15% tax that you will have to give

This is for YouTubers only, if you are a blogger then you will not have any tax. 0% tax ), but YouTubers must pay at least 15% tax.

In fact, according to Google’s announcement (US Internal Revenue Code Chapter 3), YouTube now charges creators outside the US as well, which is why I’ve set a default tax of 24% to 30%.

Meanwhile, if you prove that you are not a US citizen, you will have to pay taxes only for US views, and for that you will have to provide your tax information in the AdSense account.

Tell us how to fill Google Adsense tax information in India. So you can get approved easily.

How to Fill US Tax Information in Google AdSense Account – Complete Information in Hindi

If you are an Adsense Punlisher and have enabled monetization on your site, blog or YouTube channel, you must have received a notification on the channel or in your Adsense account.

And now you want to fill adsense tax form correctly so that you have to pay 15% tax instead of 24% then you can fill forum in following way.

That is, if you have earned $ 100 from your YouTube channel, then instead of 24% ($ 24), you will have to pay only 15% ($ 15). The remaining 85% will be sent to your bank account between the 21st and 26th.

Let’s start now and know how to fill Adsense tax information form in Hindi?

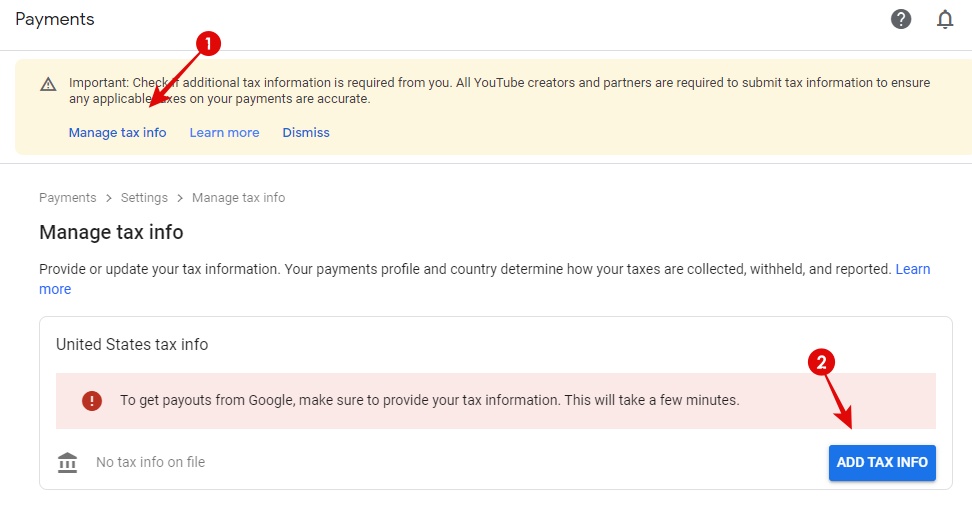

Option 1: Go to Manage Tax Information

First of all, go to your google adsense account and login with your google id. Then follow these steps.

- Go to the Adsense notification and click on the link with tax information.

- Now on the page that will open, you have to click on the Add tax information button.

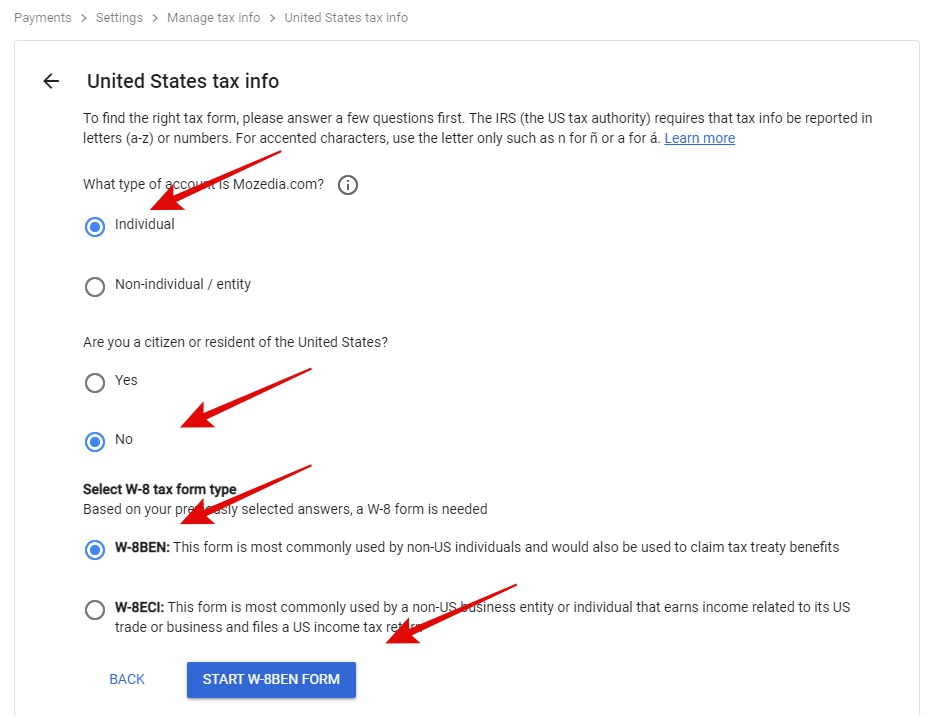

Option 2: Fill in the type of account information and choose the type of form

The US tax information page will now open where you have to fill in the fields as shown in the screenshot below.

- In the Account type select Individual , and if you have a business account, select Non-Individual/Entity.

- If you are not a US citizen, do not select and fill in the tax form Form W-8BEN , select Form W-8ECI if you have a business account.

- After that click on the button with the option Next.

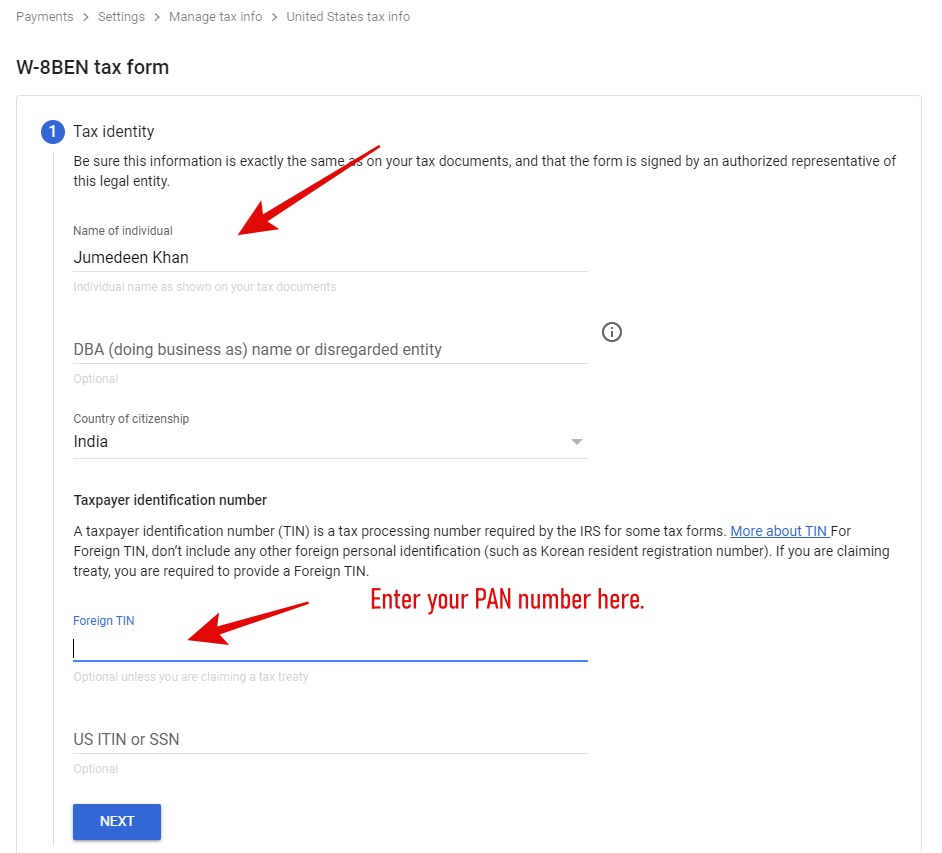

Option 3: Start filling out the adsense tax form

You will now start filling out the W-8BEN tax form, where you will first have to fill in your tax ID information, which you can fill out in the following way.

Step 1:

- Type your name in the individual’s name option. And remember, put the same name on your legal documents. And

- Select your country in the country of citizenship, if it is India, then select India.

- For that you have to enter your TIN, here you can use your PAN card number. (This is for India only.)

- Apart from the foreign tax identification number, the rest of the US ITIN or SSN field must be left blank and click on the Next button.

Note:- This step is very important because here you have to use government documents to verify your tax information.

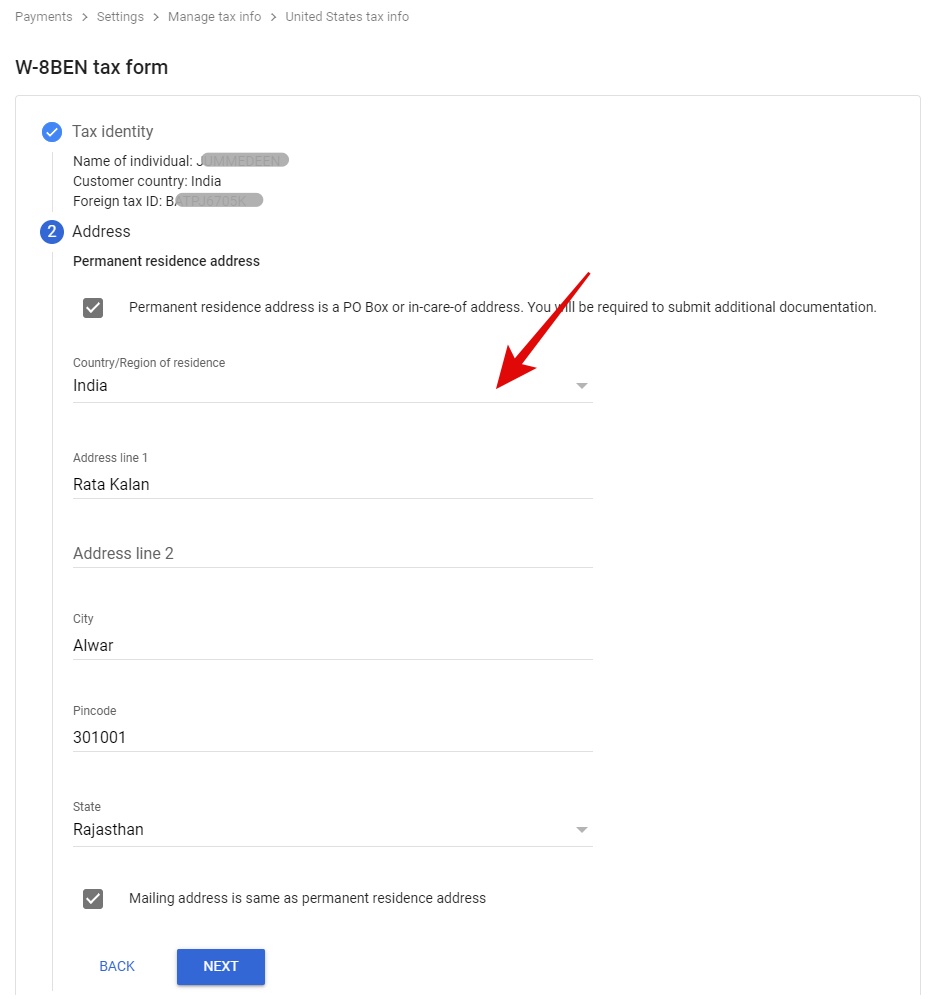

Step 2:

Now you have to fill in your address, here remember that you have to fill in the same address that you filled while checking adsense.

- Specify your permanent residence address.

- After that select your country.

- Next, fill in your address like village, city, pincode, district etc.

- Next, specify the mailing address is the same as that of permanent residence and click on the next page link.

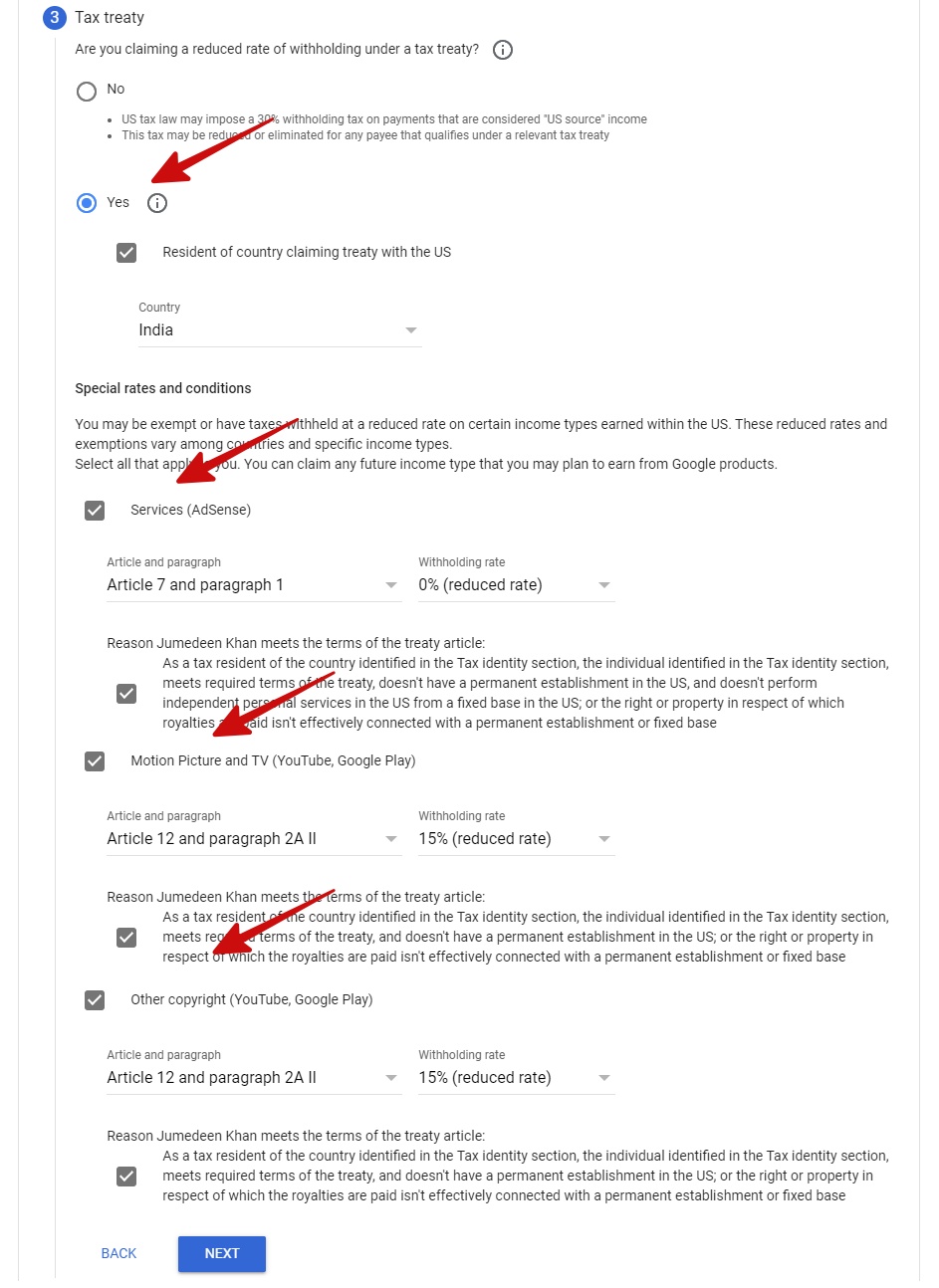

Step 3:

Here you must fill in the tax agreement information, so that you can claim the tax rate reduction.

- Select Yes, select your country in the drop-down list by selecting a resident of the country.

- In the special prices and conditions, you get to choose the services you use.

- Here you will see 3 options. The first is for the AdSense publisher (eg website owner) and the other two are for YouTube creators.

- By selecting Article 7 and Paragraph 1 in the service (AdSense) 0% rate reduction opts.

- By selecting Article 12 and Paragraph 2a2 in motion pictures and television (YouTube, Google Play) 15% rate reduction selects.

- In other copyrights (YouTube and Google Play ) also by selecting Section 12 and Paragraph 2A II 15% rate reduction opts.

- After that tick the required conditions and click on the next option.

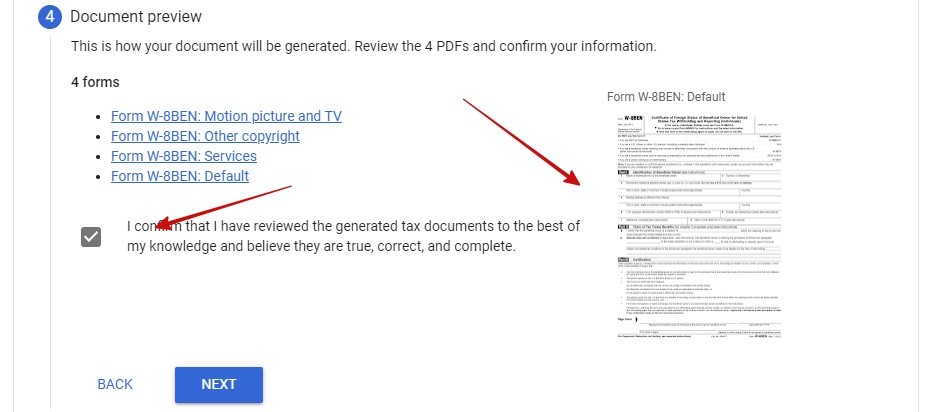

The fourth step:

Now here you will see the document preview of the information you have filled in, where you can confirm whether you have filled in the correct information or not.

- If everything filled out correctly, click on the next button link by clicking I confirm.

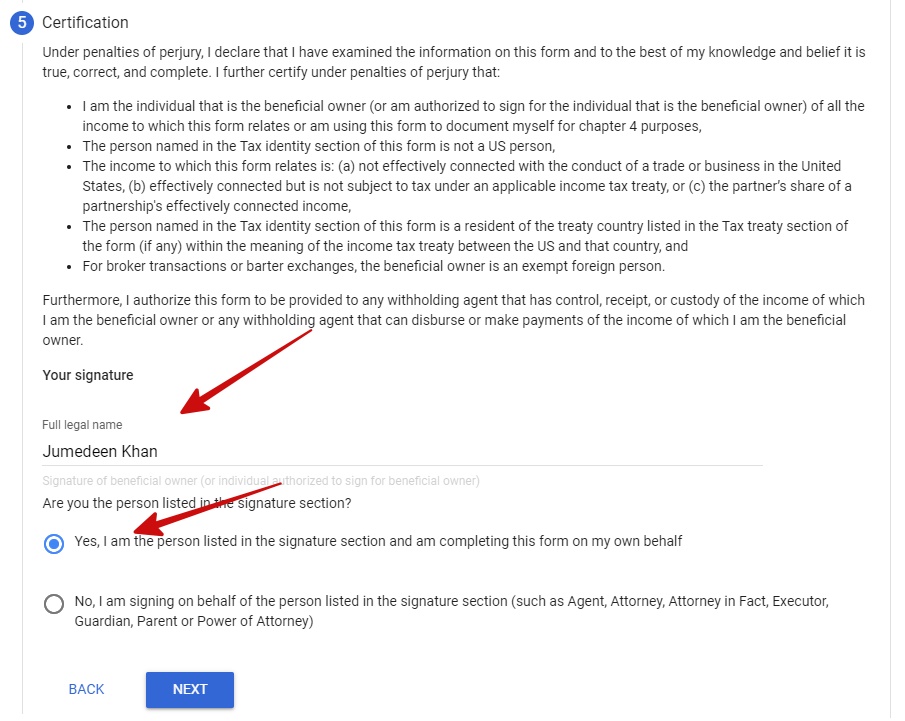

Fifth step:

You will now come to the certification page where you will be told about the penalties you will get for filling in wrong information.

You read his points carefully and understand that you did nothing wrong, then follow the next steps.

- Add your legal signature here.

- Next, check if you filled out this forum yourself or you filled it out through an agent.

- After that click on the Next button link.

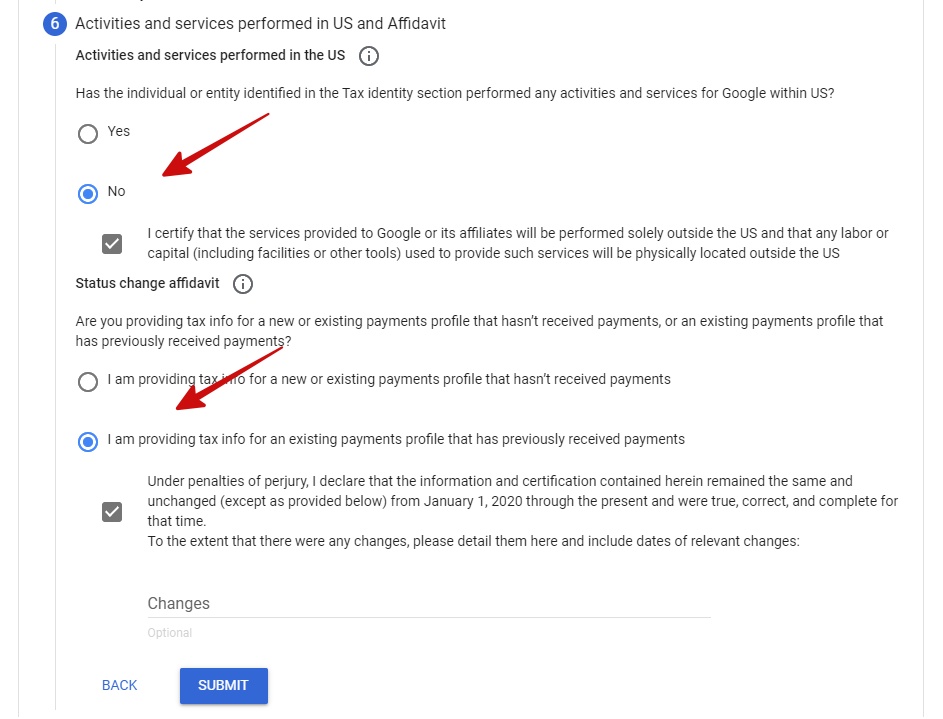

Sixth step:

This is the last step in this forum, where you are required to fill out a Statement of Activities and Services performed in the United States. Fill it out carefully and then just click on the submit button.

- Select No and then select “I acknowledge that the services provided to Google or its affiliates will only be performed outside the United States.

- Then, if you are using adsense for the first time and you have not received any Adsense payments, choose the first option.

- And if you’re already using AdSense and have already made the payment, select the second option and specify the penalty terms of an agreement.

- After that you have to hit the submit button without making any changes.

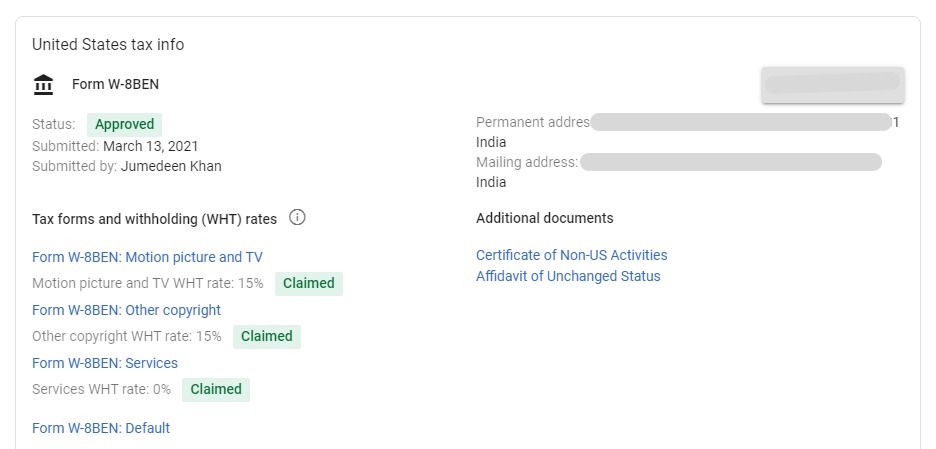

Option 4: Congratulations – getting approved

our end! You have successfully filled out the adsense taxes form, now once you have clicked the submit button and you have filled in all the information correctly, you will see the approved mark.

a little something like this,

In this way, you can easily fill out the Google AdSense tax form and avoid unnecessary taxes without any reason. Let me tell you that if you file, you don’t have to pay any taxes.

Read also: 7 best ways to earn money from WhatsApp

Some Questions Regarding Google AdSense Tax – Answers

Above we have explained in detail about filling in tax information in adsense but we know that some people may have some questions regarding this matter and you may also be one of them and you are looking for answers to your questions you came here for

This is why we are answering some questions about filling in google adsense tax information here.

Question 1: Does every YouTube creator have to fill in Adsense tax information?

Answer : According to Google’s announcement, every YouTuber (no matter where they are in the world) will have to provide tax information. Otherwise, he will have to pay a tax of 24%.

Question 2: Until when can I fill in my AdSense tax info?

Answer Google says that if you don’t provide tax information by May 31, 2022, Google may have to deduct up to 24% of your total worldwide earnings.

That’s why please provide your US Tac info to your Adsense account as soon as possible.

Question 3: Is it necessary for every YouTube creator to pay this tax?

Answer : Yes of course! Every YouTuber will have to pay this tax, even if they are not a US citizen, they will have to pay tax on the earnings of US citizens’ views on their videos.

Question 4: Do I have to fill out a tax form even if my channel is not being monetised?

Answer : No, only those people can populate this forum, whose channel is monetized and has an AdSense account.

Question 5: Will the blogger also have to pay this tax, if yes, how much?

Answer : No, bloggers or website owners won’t have to pay this tax, but if you don’t fill out the tax form, Google will charge you a 24% tax.

In fact, while filling the adsense tax form, we get 3 options in the reduction rates, with the first being the adsense services, we can choose a 0% reduction rate.

This means that their income is only from blogging, Google will take 0% tax from them, which means if you are a blogger you don’t have to pay any taxes.

Question 6: How much tax will YouTubers have to pay in India?

Answer : There is a tax treaty relationship between India and America, according to which 15 percent of the profits must be paid as tax.

For example, if an Indian YouTuber has a monthly channel income of $1,000, $100 of it comes from the US, and if he provides tax information, the deduction is $15 (15% of $100).

But, if the Indian YouTubers do not provide the details, the deduction will be $240, which is 24 percent of the total earnings, meaning worldwide earnings should be taxed.

Question 7: Should the tax be paid separately after filling out the form?

Answer : No, you will not need to pay the tax separately. Any tax fixed will be automatically deducted from your Adsense earnings.

Question 8: Why does Google take these US taxes?

Question : This is also an important question, that should be on everyone’s mind why is Google doing this at all?

In fact, it is Google’s responsibility to collect tax information on YouTube and to collect and report taxes to the US Internal Revenue Service (IRS).

In such a case, if a YouTube creator earns (worldwide) from US viewers, Google will start charging him taxes, and if he doesn’t provide this information, he will have to pay tax on his entire earnings.

Note :- We can’t give much advice on YouTube and Google tax issues. Consult a tax professional to better understand your tax situation.

Conclusion,

In today’s article, we have learned how you can fill google adsense tax information and we also provided more important information about it.

Also read this,

Apart from this, we have also provided answers to questions related to this, however, if you have any confusion regarding this, then you can ask your question in the comments section below.